You are here:Bean Cup Coffee > block

Bitcoin Price Movement in 2018: A Year of Volatility and Speculation

Bean Cup Coffee2024-09-21 12:27:09【block】5people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In 2018, the world of cryptocurrency experienced a rollercoaster ride, with Bitcoin, the leading cry airdrop,dex,cex,markets,trade value chart,buy,In 2018, the world of cryptocurrency experienced a rollercoaster ride, with Bitcoin, the leading cry

In 2018, the world of cryptocurrency experienced a rollercoaster ride, with Bitcoin, the leading cryptocurrency, witnessing unprecedented price movements. The year began with a bull run, but it soon turned into a bear market, leaving investors in a state of confusion and uncertainty. This article aims to analyze the Bitcoin price movement in 2018, highlighting the key factors that influenced its volatile journey.

Bitcoin Price Movement in 2018: The Bull Run

The year 2018 started on a positive note for Bitcoin. The cryptocurrency reached an all-time high of nearly $20,000 in December 2017, driven by a surge in investor interest and media hype. Many people believed that Bitcoin had the potential to become the future of money, and its price movement in 2018 reflected this optimism.

Bitcoin Price Movement in 2018: The Bear Market

However, the bull run was short-lived. As the year progressed, Bitcoin's price began to decline, and the cryptocurrency entered a bear market. The downward trend continued throughout the year, with Bitcoin's price plummeting to around $3,200 by December 2018. This massive drop in value left investors reeling and questioning the future of Bitcoin.

Several factors contributed to the Bitcoin price movement in 2018. One of the primary reasons was regulatory uncertainty. Governments around the world were grappling with how to regulate cryptocurrencies, and this uncertainty created a negative sentiment in the market. Additionally, the mainstream media's portrayal of Bitcoin as a speculative bubble further fueled the bear market.

Another significant factor was the entry of institutional investors into the cryptocurrency market. While some investors welcomed this development, others were concerned that institutional involvement could lead to excessive speculation and volatility. As a result, Bitcoin's price movement in 2018 was heavily influenced by the actions of institutional investors.

Moreover, the year 2018 saw several high-profile hacks and security breaches in the cryptocurrency space. These incidents eroded investor confidence and contributed to the downward trend in Bitcoin's price. The collapse of major cryptocurrency exchanges, such as Coincheck and Binance, also played a role in the Bitcoin price movement in 2018.

Bitcoin Price Movement in 2018: Lessons Learned

Despite the volatility, the Bitcoin price movement in 2018 provided several lessons for investors and the cryptocurrency community. Firstly, it highlighted the importance of due diligence and research before investing in cryptocurrencies. Secondly, it emphasized the need for robust security measures to protect investors' assets. Lastly, it underscored the significance of regulatory clarity to foster a healthy and sustainable cryptocurrency market.

In conclusion, the Bitcoin price movement in 2018 was a rollercoaster ride of volatility and speculation. The cryptocurrency's price skyrocketed at the beginning of the year but soon plummeted into a bear market. Several factors, including regulatory uncertainty, institutional involvement, and security breaches, contributed to this volatile journey. However, the lessons learned from this experience can help shape the future of the cryptocurrency market and ensure a more stable and secure environment for investors.

This article address:https://www.nutcupcoffee.com/eth/72f53699391.html

Like!(2996)

Related Posts

- **Stack Overflow Bitcoin Mining Algorithm: A Comprehensive Guide

- Buy Bitcoin with Bank Transfer in Canada: A Comprehensive Guide

- www.bitcoinbarrel.com Bitcoin Mining Pool: A Comprehensive Guide to Joining and Maximizing Your Earnings

- Binance Price Coindesk: The Ultimate Guide to Cryptocurrency Market Analysis

- Claim Bitcoin Wallet: A Comprehensive Guide to Securely Managing Your Cryptocurrency

- Bitcoin Wallet to Wallet Transfer Time: Understanding the Duration and Factors Influencing It

- **The Thrill of Mining a Bitcoin: A Journey into the Digital Gold Rush

- How to Recover Crypto Sent to the Wrong Address on Binance

- How is Mining Bitcoin Reported?

- Application-Specific Integrated Circuits Bitcoin Mining: The Future of Cryptocurrency Mining

Popular

Recent

How to Send BNB from Binance to Trust Wallet: A Step-by-Step Guide

The Rise of the Most Popular Bitcoin Wallet in 2013

Binance, the leading cryptocurrency exchange, has been at the forefront of facilitating transactions in various digital assets, including Bitcoin (BTC) and Tether (USDT). One such popular trading pair on Binance is the BAT/USDT pair, which has seen significant interest from traders and investors alike. In this article, we will delve into the BAT/USDT binance trading pair, exploring its characteristics, market dynamics, and potential opportunities.

Bitcoin Mining Farms in Canada: A Growing Industry

Bitcoin Last Month Price in INR: A Comprehensive Analysis

What Coins Does Binance US Have: A Comprehensive Guide

Bitcoin Wallet Anonym: The Ultimate Guide to Secure and Private Cryptocurrency Transactions

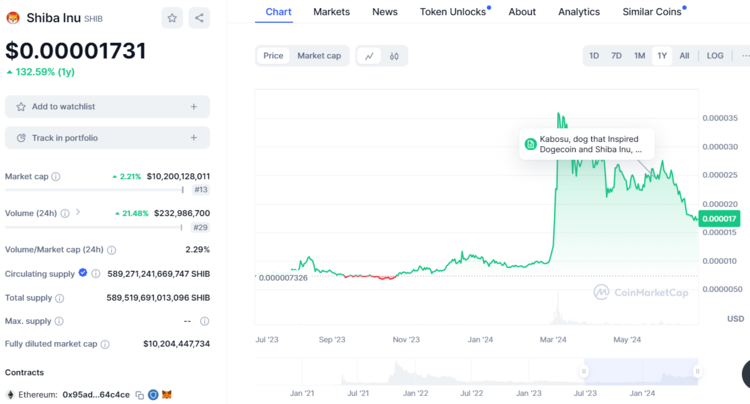

Shiba Inu Trade Binance: A Comprehensive Guide to Trading the Popular Cryptocurrency

links

- Bitcoin Cash Mining Guide: A Comprehensive Overview

- How to Transfer Money from Binance to Coinbase: A Step-by-Step Guide

- How to Send USDC to Binance Smart Chain: A Step-by-Step Guide

- Can I Buy Bitcoin Thru Fidelity?

- How to Transfer Crypto to Crypto on Binance: A Step-by-Step Guide

- Will Bitcoin Recover from Bitcoin Cash?

- Can U Buy Ripple on Binance: A Comprehensive Guide

- Can Anyone Become a Bitcoin Miner?

- How Do I Get Binance Smart Chain Address: A Comprehensive Guide

- Bitcoin Wallet from Private Key: The Ultimate Guide to Creating and Managing Your Cryptocurrency Portfolio